A B.Com degree and ₹35,000.

If I ask you to give me a list of people who had the above combination in 1990, chances are that you will be able to think about a lot of them.

Probably, what these people will not have is a net worth of ₹1480 Crores as of December 2023.

That is what stocks did for Mr. Vijay Kedia. In 1990, he started with an initial capital of ₹35,000. As of December 2023, he owns stock in about 15 companies worth ₹1480 Crores.

How did he do it?

Let’s find out in Part 2 of The New Investor Series!

What can Investing do for you?

Born in a middle-class family Mr. Vijay Kedia is a full-time investor—one of India’s most successful. In 33 years, he created extraordinary wealth during his investing journey.

Other able investors have also achieved similar success in India.

I encourage you to read about their stories.

Where did they start from?

How did they reach here?

Now, you may think that these people are the exception rather than the norm and you will be right. They have superior stock selection skills, temperament, and vision than the average investor. But these qualities can be learned.

By talking about the success stories of these investors, I am not assuring you that you will earn thousands of crores if you invest in the stock market. My only aim is to tell you that it can be done with modest beginnings.

All of these investors started small.

If not thousands of crores, investing can give you a decent path to early financial freedom. (and maybe a few hundred crores by the time you’re done eh?).

Let me tell you how with simple math.

The Magic of Compounding

Albert Einstein said:-

Compound Interest is the 8th wonder of the world.

What does that mean? Let’s see with an example.

You all know what is a Fixed Deposit. It’s what your grandfather probably invested in all his life. It is the money you give to a bank on which it pays you interest at regular intervals. The current Interest Rate on an FD in India as of December 2023 is about 7-7.5% per annum. If you create a fixed deposit today it will earn this interest rate for the years to come.

Similarly, if you consider the top 30 publicly listed companies in India, the annual growth rate for the last 55 years, has been approximately 19%. If you see the Top 50 Companies (forming the Nifty 50), the growth comes to ~14%.

Let’s see what this can do.

If you take out Rs. 40,000 from your monthly income and blindly invest in the Top 30 companies that earn this annual return of ~19%, without regard to individual stock selection, how much money will you have after 40 years?

Take a guess and think about a number before I answer.

It’s ₹483 Crores. Yes, you read that right.

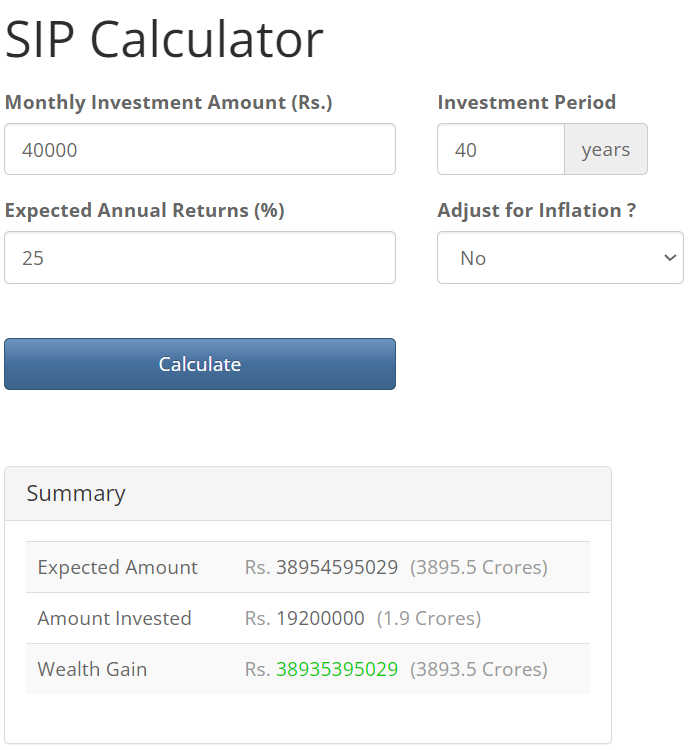

You can confirm the calculations using this SIP Calculator.

The Real Magic of Compounding

Now watch what happens when you change the annual return assumption from 19% to 25%.

The answer changes to Rs. 3895 Crore.

That is the magic of compounding for you. A measly difference of 6% per year translates to a huge total difference in wealth over 40 years. The investors I talked about earlier have done this successfully.

Through superior stock selection, business analysis, temperament, and a bit of luck—YOU can do it too.

The stock market empowers ordinary people with ordinary incomes to build extraordinary wealth.

The Stress Test

Even if you change the monthly investment from Rs. 40,000 to Rs. 20,000, you’ll end up with a big enough number. I encourage you to try it out.

Adjust for inflation if you want (historical Indian average inflation is ~5.5%).

If you don’t have 40 years, you can be financially free in 10-15 years.

Change the return assumption from 19% to a different number, say 14%, and tell me what you end up with.

You can even work backward. How much do you need to invest each month at 14% to earn your first crore?

I encourage you to try these scenarios and reply to this email with your findings.

Shoot for the moon, even if you miss you will land among the stars.

—Norman Vincent Peale

What Next?

Coming back to Mr. Vijay Kedia, he emphasizes three things—Knowledge, Courage, and Patience.

All three of these skills can be built over time. The Investment Compass and the accompanying community can help you in your journey.

Also, all of the successful investors I mentioned above agree unanimously that the next 2-3 decades for India will be much better than the last few decades in terms of growth.

I leave you to imagine what can happen.