How to start investing?

What can you learn from a group of 13 year old children? In today's issue #05 of The New Investor Series, we're going to learn about where to look for good companies (hint: its closer than you think!)

The Story

In 1990, a class of 13-year-old children was asked to pick a selection of stocks. The performance of these stocks was then monitored over the next 2 years.

They returned 320%. The market return during this period was ~26%.

Oh and also, the portfolio beat 99% of ‘professional’ fund managers.

This story came to the attention of Peter Lynch, who was managing the Fidelity Magellan fund with over $14 billion in assets. He set up a meeting with the teacher.

The teacher then explained the first rule she had set for the students.

"Before my students can put any stock in the portfolio, they have to explain exactly what the company does. If they can't tell the class the service it provides or the products it makes, then they aren't allowed to buy."

What were some of the winning stocks?

Nike Inc., The Walt Disney Company, GAP Inc., etc.

The kids figured that if they liked the products these companies sold, other people would like them too, hence the companies would do well in the future.

Simple—Beautiful.

Start looking around

Most—if not all of you, are not full-time investors. You work in some industry or the other. If you’re a doctor, you know how hospitals work. If you’re an air hostess, you know what airlines are doing well. If you’re a pharmacist, you know which medicines sell better.

Start looking into the companies behind good products. It is often the best starting point for investment research.

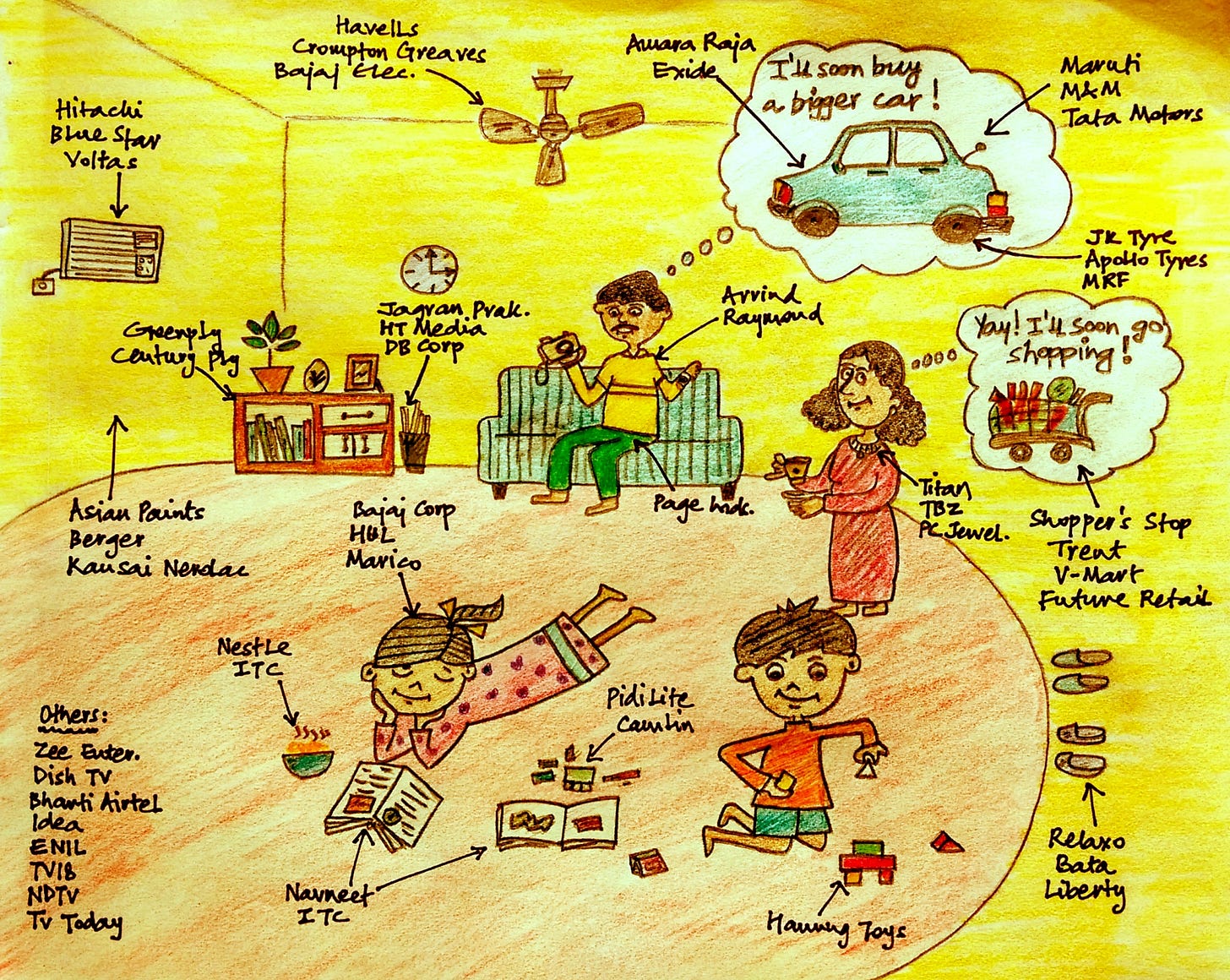

Look at the image below by Vishal Khandelwal.

You are already connected to a lot of products and companies—just look around you!

Vishal has already written a good article around this topic—find it here.

Curiosity is the way forward

Do you like the Royal Enfield Motorcycles? If you had invested Rs. 50,000 in the company which sells them—Eicher Motors, it would have grown to about Rs. 1.07 crores in 20 years.

Just look around you. What brand of ketchup do you love? Who makes the best shoes? Whose clothes are just wow? You get the point.

Peter Lynch made a whole career out of basing investments around good products around him (think Gillette Blades and Domino’s Pizza). His fund returned ~29% over 13 years.

Don’t just look—ask

Who made this?

What makes it popular?

Do they have a loyal customer base?

Is this likely to be a fad or a structural trend?

Is the company innovative or efficient? Can you understand how it makes money?

A Basic Roadmap

Identify a good product or service (these can also be trends and changes).

Read and find out all that you can about the company (if there was smoke in the past, there would’ve been a fire too).

Learn basic financial analysis and valuation

This ensures that you don’t pay too much for a company, and

You don’t buy duds (seemingly cheap companies with almost no growth).

Identify potential risks and threats to your thesis

If you’re able to tick all boxes and are willing to hold the company for a fairly long period—Buy it.

Make sure that you understand the business.

Let me show you an example, a cycle that I have seen repeating countless times.

A doctor who invests in stocks is researching a Real Estate Company

He has invested in the company, and the company is doing well, selling homes and earning money

The stock does well, and the investor is happy

While the stock is on its way up, the underlying business is changing—the housing market starts to take a turn for the worse

The investor (Mr. Doctor) misses some crucial data that is a leading indicator of the real estate cycle turning

He ends up losing a good part of his profits, maybe even selling at a loss.

You can replace doctor with any other profession and real estate with any other sector where the investor is not well versed.

If the business is something that you don’t understand, chances are—you will miss something about it.

Do you know what would changes Mr. Doctor be privy to before they happened? Changes in the healthcare sector.

Medicines, Hospitals, Diagnostic Chains, etc.

While it is possible to invest successfully in unrelated sectors, for those just starting it is a great idea to stick to what you understand.

In the end, Investing is a probability game, keep the probability on your side.

The Library

This is probably the most suggested first investing book, and for good reason. The language is simple, the ideas solid, and the writer—Peter Lynch.

Grab a copy of One Up on Wall Street and read it to learn more about the secrets of proxy investing and looking for good companies right under your nose.

Know what you own, and know why you own it

— Peter Lynch